Ferrous Scrap Price Index last week 19-23 Sept. was down by more than 2 percent after Turkey and China metal traders came back on their trade areas after holidays, the stock experts said. Import prices in US East Coast, Baltics, Indian, Taiwan followed by Turkish indeces vary greatly. This was a major trend last week, when most of the prices for raw materials were to go down again including fossils and natural sources of energy. After two first transactions in China even Australian premium hard coking coal have fallen first time for two months despite of "hot season".

The investment bank Goldman Sachs kept its sound on optimistic note and raised its near-term spot price forecast for coking coal and other raw commodities after supply shock in China. The analysts of Goldman Sachs preserve positive expectations for a more balanced Supply-and-Demand Report for 2017 year. Meantime, the gap between Asian and China’s domestic and export prices for ferrous scrap billet has widened recently. The world ferrous scrap prices illustrate this rip and show a global decline of industrial production in building, metal working and automotive sectors including shipbuilding.

Ferrous Scrap Price Index Keeps Weakening Globally

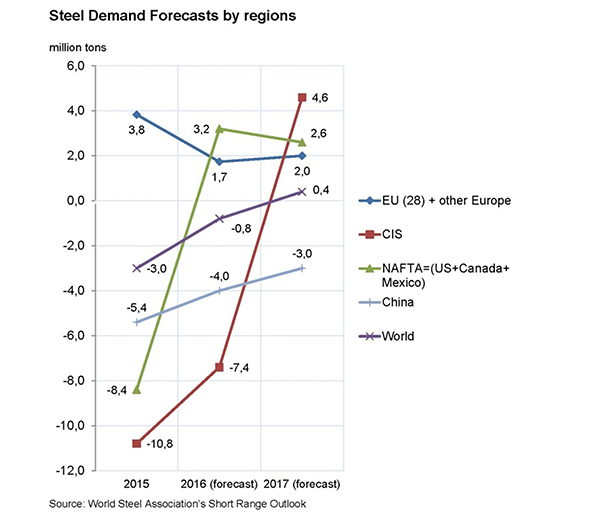

The forecast for all metal demand in Short Range Oulook dated of April 2016 made by World Steel Association demonstrates shortening of metal demand in the whole world. It is the main motivator for lowering of the prices for metal scrap. Some figures are shown on graph (see fig. 1) illustrate the hardships in China economy are still on the way even in 2017. Some revival in world metalworking relates mostly on account of NAFTA (US, Canada and Mexico trade Union) region and in less measure to MENA region (Middle East and North Africa). China is still the biggest world demotivator of metal scrap processing as before and pushes down first of all the purchase prices in Turkey.

The revival in world metal processing is expected in 2017 without compromise for better prices for scrap in 2016.

Fig. 1. Demand of finished steel products in 2015 and forecast for 2016-2017 by World Steel Association, million tons.

European expectation for recovery of EU economy comes true very slowly and any negative reason can push it out from the thin edge. The same relates to the metal scrap market in EU. The separated figures for EU and other European countries Short Range Oulook by World Steel Association for 2016 shows that EU even still more in depression than other European economies. All finished steel products demand of non-EU states shows positive dynamic from 8% in 2015 to 3% in 2016 and 2017. At the same time EU demonstrates weakening from 2.8% in 2015 to 1.4% in 2016 and minimal growth by 0.3% to 1.7% in 2017.

Ferrous Scrap Price Indexes on Indian and Turkish Markets

Turkish steel plants resumed their import purchases through deep-sea ports starting on September 21 and saved this trend for lower Ferrous Scrap Price Index. Most of experts predict such tendency to be in force for next week too.

Turkish steel producers freighted three deep-sea cargoes of scrap on Wednesday, signing one Baltic Sea deal on Thursday and two more contracts at the end of the week.

A steel processor in Turkey contracted on September 21 a US cargo ship and another cargo from Baltic Sea, comprising:

- 20000 tons of HMS 1&2 (80:20) at $215 per ton;

- 17000 tons of shredded scrap at $220 per ton;

- 3000 tons of bonus at $225 per ton CFR;

- 16000 tons of HMS and black mixed scrap 1&2 (80:20) at $213.75 per ton and more 4000 tons with less mark of average Ferrous Scrap Price Index.

Such sluggish activity can not substantially affect on rising the Ferrous Scrap Price Index, more over, it was a signal for raw metal prices to move down despite of Indian import scrap prices slowly moved in opposite directions on London stock till Sep 23, 2016 16:38, but at the end of trade day prices regrouped, shown the return to declining and confirmed general trend.

US Ferrous Scrap Price Index for Export Slides Down 15% during Jan-July

The US scrap export fell approximately by 3.3% comparatively with the 2015 mark, despite of the shipments to Turkey – a leading receiver of US export comodities. The US waste metal exports to Turkey had totaled 900500 tons during July 2015. The net tonnage of monthly exports have declined harshly by over 19% to $256.4 million by year-on-year basis.

Turkey was the biggest importer of US metal scraps during the months. The Turkish purchase of US metal scrap decreased intensely by nearly 22% if compared to Q1 and Q2 in 2015.

The Mexican imports of US metal scrap was on second place and now totaled 150967 tons. It has dropped significantly since the previous month imports of 222579 tons. Taiwan occupied the third place with total value of 139715 tons of US ferrous scrap during the month. The US exports of metal scraps to Taiwan abated by over relatively 43%, whilst the delivering to South Korea dropped by over 21% in Jan-July 2016. The fall in shipments to these countries were recover mainly by leverage to India, Mexico and Canada. The shipments to India have risen by 34% year-on-year; those to Mexico have been up by 28%. The shipments to India have risen by 34% year-on-year; those to Mexico have been up by 28%. The deliveries to Canada have leveled up a bit by 2.8% over the previous year. The US metal waste exports to China dropped more than 28% upon comparison within Jan-July 2015.

The cumulative US scrap shipments for the first seven months of this year were summarised at the amount of 6.68 million tons. It is less by 15% as for the same period in 2015.

Ferrous Scrap Price Index is to Rise in 2017

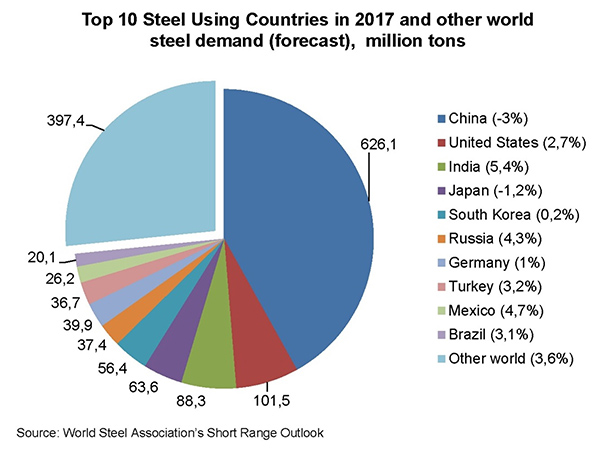

The decline of the world purchasing demand for raw materials has demonstrated lower average of Ferrous Scrap Price Index than in the same period for the previous year. It confirms the global expectation of metal traders due to continuing recession in China metal industry. Negative domestic Chinese demand for metal caused mostly the declining in building, energy and vehicle sectors. This situation can not be fixed by lowering prices on energy fossils. The greatest economy in the world has indicated its negative tendencies for the last years.

The situation in the steel industry continues to be severe due to China’s slump affects globally on most of indicators influencing the instability in financial markets, weak growth in global trade, low oil and energy fossils and other commodity prices. This depression likewise has left its mark on scrap market. The world steel market is afflicted from inadequate investments and went on weakening in the processing industry. All steel comodities demand in China will have negative result comparatively with 2015, but the decline in 2017 is to be less than in 2016.

Fig. 2. Steel Demand Forecasts for the biggest Steel Using Countries by World Steel Association Outlook 2016, million tons.

The forecast predicts slow world market resuscitation the next year, including China. Positive growth in some other key regions especially in NAFTA and EU is expected. Growth demand for steel commodities including ferrous scrap in all markets expects in 2017.